導讀

IMF更新的全球經(jīng)濟展望指出,全球經(jīng)濟開始進入實現(xiàn)軟著陸的最后階段,通脹穩(wěn)步下行,增長得到鞏固。但經(jīng)濟擴張的步伐仍然緩慢,未來可能會出現(xiàn)動蕩。

去年下半年,由于需求和供給因素支撐了主要經(jīng)濟體的增長,全球經(jīng)濟活動呈現(xiàn)出韌性。在需求方面,盡管貨幣環(huán)境緊縮,但私人和政府支出增強,維持了經(jīng)濟活動。在供給方面,盡管地緣政治不確定性再度加劇,但勞動力參與率的提高、供應鏈的修復以及能源和大宗商品價格的下跌都起了有益的作用。

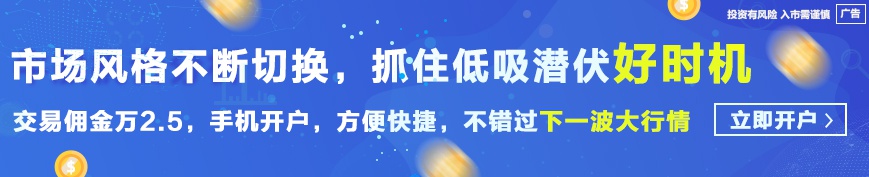

這種韌性將延續(xù)下去。根據(jù)IMF的基線預測,今年全球經(jīng)濟增速將穩(wěn)定在3.1%,較去年10月的預測值上調(diào)0.2個百分點,明年增速將小幅升至3.2%。

通脹持續(xù)下降。除阿根廷外,全球總體通脹今年將降至4.9%,較我們?nèi)ツ?0月的預測值(也不包括阿根廷)下降了0.4個百分點。核心通脹(不包括波動較大的食品和能源價格)也呈下降趨勢。發(fā)達經(jīng)濟體今年的總體和核心通脹平均約為2.6%,接近央行的通脹目標。

但不確定性依然存在,各國央行現(xiàn)在面臨雙重風險。我們面臨的最大挑戰(zhàn)是應對不斷上升的財政風險。多數(shù)國家在走出疫情和能源危機后都面臨更高的公共債務水平和借款成本。降低公共債務和赤字將為應對未來的沖擊提供空間。政策重點必須轉(zhuǎn)向修復公共財政和改善中期增長前景。各國需要加快步伐以應對世界面臨的諸多結(jié)構(gòu)性挑戰(zhàn):氣候轉(zhuǎn)型,可持續(xù)發(fā)展,以及提高生活水平。

作者丨Pierre-Olivier Gourinchas(IMF研究部主任)

Global Economy Approaches Soft Landing, but Risks Remain

Policy focus must shift to repairing public finances and improving medium-term growth prospects

Pierre-Olivier Gourinchas

January 30, 2024

The clouds are beginning to part. The global economy begins the final descent toward a soft landing, with inflation declining steadily and growth holding up. But the pace of expansion remains slow, and turbulence may lie ahead.

Global activity proved resilient in the second half of last year, as demand and supply factors supported major economies. On the demand side, stronger private and government spending sustained activity, despite tight monetary conditions. On the supply side, increased labor force participation, mended supply chains and cheaper energy and commodity prices helped, despite renewed geopolitical uncertainties.

This resilience will carry over. Global growth under our baseline forecast will steady at 3.1 percent this year, a 0.2 percentage point upgrade from our October projections, before edging up to 3.2 percent next year.

Important divergences remain. We expect slower growth in the United States, where tight monetary policy is still working through the economy, and in China, where weaker consumption and investment continue to weigh on activity. In the euro area, meanwhile, activity is expected to rebound slightly after a challenging 2023, when high energy prices and tight monetary policy restricted demand. Many other economies continue to show great resilience, with growth accelerating in Brazil, India, and Southeast Asia’s major economies.

Inflation continues to ease. Excluding Argentina, global headline inflation will decline to 4.9 percent this year, down 0.4 percentage point from our October projection (also excluding Argentina). Core inflation, excluding volatile food and energy prices, is also trending lower. For advanced economies, headline and core inflation will average around 2.6 percent this year, close to central banks’ inflation targets.

With the improved outlook, risks have moderated and are balanced. On the upside:

·Disinflation could happen faster than anticipated, especially if labor market tightness eases further and short-term inflation expectations continue to decline, allowing central banks to ease sooner.

·Fiscal consolidation measures that governments have announced for 2024-25 may be delayed as many countries face rising calls for increased public spending in what is the biggest global election year in history. This could boost economic activity, but also spur inflation and increase the prospect of disruption later.

·Looking further ahead, rapid improvement in Artificial Intelligence could boost investment and spur rapid productivity growth, albeit one with significant challenges for workers.

On the downside:

·New commodity and supply disruptions could occur, following renewed geopolitical tensions, especially in the Middle East. Shipping costs between Asia and Europe have increased markedly, as Red Sea attacks reroute cargoes around Africa. While disruptions remain limited so far, the situation remains volatile.

·Core inflation could prove more persistent. The price of goods remains historically elevated relative to that of services. The adjustment could take the form of more persistent services—and overall—inflation.Wage developments, particularly in the euro area, where negotiated wages are still on the rise, could add to price pressures.

·Markets appear excessively optimistic about the prospects for early rate cuts. Should investors re-assess their view, long-term interest rates would increase, putting renewed pressure on governments to implement more rapid fiscal consolidation that could weigh on economic growth.

Policy challenges

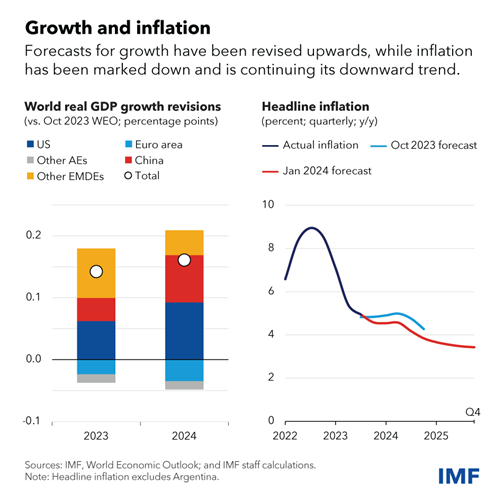

With inflation receding and growth remaining steady, it is now time to take stock and look ahead. Our analysis shows that a substantial share of recent disinflation occurred via a decline in commodity and energy prices, rather than through a contraction of economic activity.

Since monetary tightening typically works by depressing economic activity, a relevant question is what role, if any, has monetary policy played? The answer is that it worked through two additional channels. First, the rapid pace of tightening helped convince people and companies that high inflation would not be allowed to take hold. This prevented inflation expectations from persistently rising, helped dampen wage growth, and reduced the risk of a wage-price spiral. Second, the unusually synchronized nature of the tightening lowered world energy demand, directly reducing headline inflation.

But uncertainties remain and central banks now face two-sided risks. They must avoid premature easing that would undo many hard-earned credibility gains and lead to a rebound in inflation. But signs of strain are growing in interest rate-sensitive sectors, such as construction, and loan activity has declined markedly. It will be equally important to pivot toward monetary normalization in time, as several emerging markets where inflation is well on the way down have started doing so already. Not doing so would jeopardize growth and risk inflation falling below target.

My sense is that the United States, where inflation appears more demand-driven, needs to focus on risks in the first category, while the euro area, where the surge in energy prices has played a disproportionate role, needs to manage more the second risk. In both cases, staying on the path toward a soft landing may not be easy.

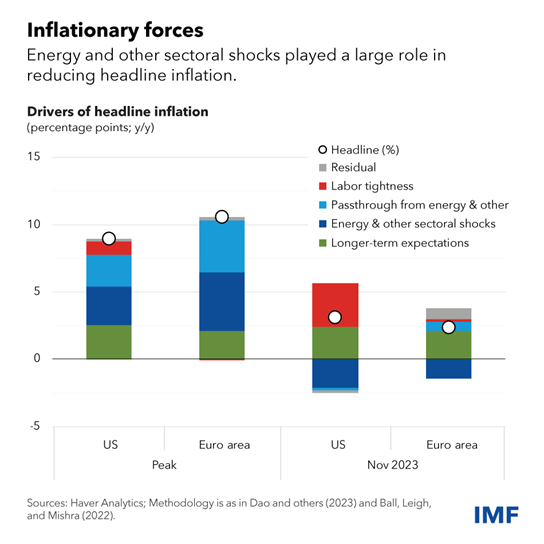

The biggest challenge ahead of us is to tackle elevated fiscal risks. Most countries came out of the pandemic and energy crisis with higher public debt levels and borrowing costs. Bringing down public debt and deficits will give space to deal with future shocks.

Remaining fiscal measures introduced to offset high energy prices should be phased out right away, as the energy crisis is behind us. But more is needed. The danger is two-fold. The most pressing risk is that countries do too little. Fiscal fragilities will build up until the risk of a fiscal crisis forces sudden and disruptive adjustments, at great cost. The other risk, already relevant for some countries, is to do too much, too soon, in the hope of convincing markets of ones’ fiscal rectitude. This could endanger growth prospects. It would also make it much harder to address imminent fiscal challenges such as the climate transition.

What to do then? The answer is to implement a steady fiscal consolidation, with a non-trivial first installment. Promises of future adjustment alone will not do. This first installment should be combined with an improved and well-enforced fiscal framework, so future consolidation efforts are both sizable and credible. As monetary policy starts to ease and growth resumes, it should become easier to do more. The opportunity should not be wasted.

Emerging markets have been very resilient, with stronger-than-expected growth and stable external balances, partly due to improved monetary and fiscal frameworks. Yet divergence in policy between countries may spur capital outflows and currency volatility. This calls for stronger buffers, in line with our Integrated Policy Framework.

Beyond fiscal consolidation, the focus should return to medium-term growth. We project global growth of 3.2 percent next year, still well below the historical average. A faster pace is needed to address the world’s many structural challenges: the climate transition, sustainable development, and raising living standards.

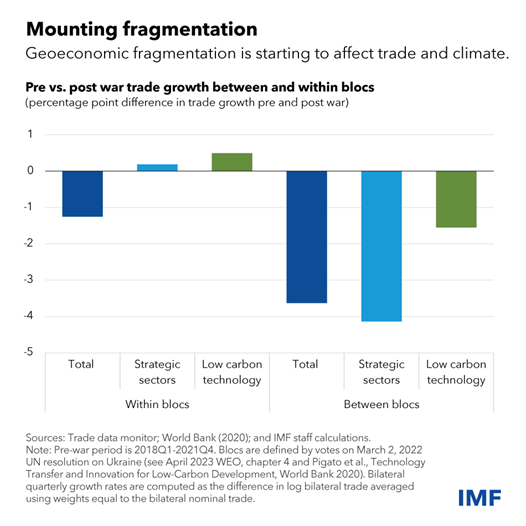

Reforms that ease the most binding constraints to economic activity, such as governance, business regulation and external sector reform, can help unleash latent productivity gains,our research shows. Stronger growth could also come from limiting geoeconomic fragmentation by, for instance, removing the trade barriers that are impeding trade flows between different geopolitical blocs, including in low-carbon technology products that are crucially needed by emerging and developing countries.

Instead, we should strive to keep our economies more interconnected. Only by doing so can we work together on shared priorities. Multilateral cooperation remains the best approach to address global challenges. Progress toward that, such as the recent 50 percent increase of the Fund’s permanent resources, is welcome.

內(nèi)容監(jiān)制: 董熙君

版面編輯|劉書廷

責任編輯|李錦璇、蔣旭

來源:IMI財經(jīng)觀察

責任編輯:石秀珍 SF183

VIP課程推薦

APP專享直播

熱門推薦

收起

24小時滾動播報最新的財經(jīng)資訊和視頻,更多粉絲福利掃描二維碼關(guān)注(sinafinance)