劉岱:華菱認沽權證保本投資策略分析

http://www.sina.com.cn 2006年08月16日 16:07 新浪財經

劉岱

2006年8月16日

(特別說明:此稿件為銀河證券研究中心供新浪獨家使用,其他網站請勿擅自轉載!)

一、華菱認沽權證基本情況

華菱認沽權證(038003)是2006年3月2日上市交易的歐式認沽權證,到期日為2008年3月1日,規模為6.33億份。初始行權價為4.90元,6月23日調整后的最新行權價為4.769元。

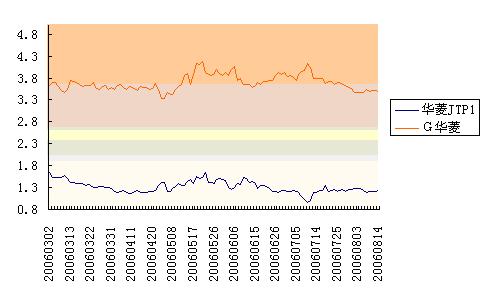

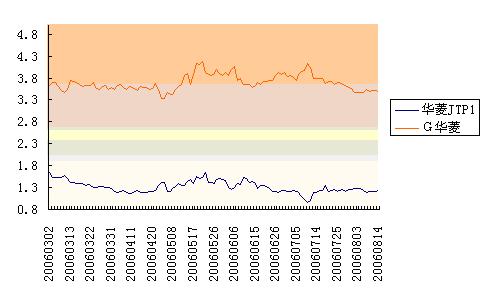

相比其它權證,該權證上市交易以來走勢平穩。見圖1。

圖1 華菱認沽權證與G華菱股票走勢

二、華菱認沽權證保本投資組合策略

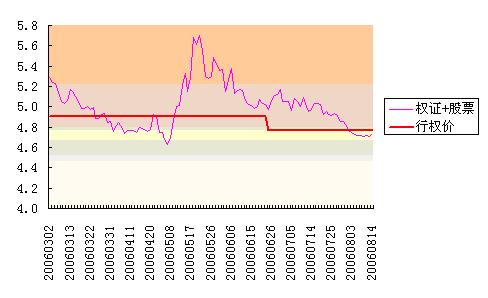

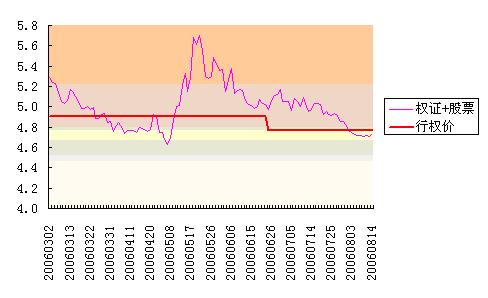

華菱認沽權證給我們提供了保本投資的機會。圖2中紅線為華菱認沽權證的行權價,粉紅線是每日華菱認沽權證收盤價與G華菱股票收盤價之和。粉紅線低于紅線的部分說明,在該交易日同時買入相同數量的華菱認沽權證和G華菱股票,可以確保投資不虧本,到期行權可以獲得無風險收益。

如2006年4月28日(此時距到期還有1.8年),權證價格為1.206元,股票價格3.42元,兩者之和為4.626元,比當時的行權價4.9元低8.01%,即使考慮交易費用,也比行權價低7.62%。也就是說,該日買入華菱權證與G華菱股票組合的投資者,到期行權可獲得7.62%的無風險收益,遠高于同期存款利率。

7%以上收益率出現的機會并不多,持有該組合的目的也并不是為了獲得這個收益。我們知道,認沽權證與標的股票組合構成一個認購權證,即當G華菱股票上漲時,該組合價值將上漲。如果看好G華菱股票,就可在粉紅線低于紅線的位置買入權證與股票組合。如果G華菱如預期一樣上漲,該組合便可以較高的收益獲利了結;如果G華菱持續下跌,持有組合的投資者至少可以持有到期,通過行權獲得無風險收益,確保本金不受損失。

圖2 華菱認沽權證與G華菱組合走勢

從華菱權證及其它認沽權證的交易情況看,權證價格與標的股票價格之和低于行權價只是暫時的,會很快向行權價回歸并超出。而華菱認沽權證還有1年半到期,G華菱股價在此期間上漲機會很多,因此該組合獲得超過無風險收益的概率很大。

最近8個交易日,華菱認沽權證和G華菱股票收盤價之和一直低于行權價,給投資者提供了保本投資的機會。見附表。

負的溢價率表示到期行權有正的收益。最近一個交易日(8月14日)買入華菱權證與股票組合,至少可獲得無風險收益0.86%,去除交易費用后的收益為0.48%。

2006年8月16日

附表:華菱認沽權證溢價率表

日期 |

剩余期限

(年) |

華菱 JTP1 |

G華菱 |

溢價率 |

權證 +股票 |

溢價率

(考慮交易費) |

行權價 |

2006-3-2 |

2.00 |

1.645 |

3.64 |

10.58% |

5.285 |

10.93% |

4.9 |

2006-3-3 |

2.00 |

1.531 |

3.71 |

9.19% |

5.241 |

9.55% |

4.9 |

2006-3-6 |

1.99 |

1.532 |

3.7 |

8.97% |

5.232 |

9.33% |

4.9 |

2006-3-7 |

1.99 |

1.532 |

3.61 |

6.70% |

5.142 |

7.07% |

4.9 |

2006-3-8 |

1.98 |

1.53 |

3.52 |

4.26% |

5.05 |

4.63% |

4.9 |

2006-3-9 |

1.98 |

1.576 |

3.46 |

3.93% |

5.036 |

4.31% |

4.9 |

2006-3-10 |

1.98 |

1.513 |

3.55 |

4.59% |

5.063 |

4.96% |

4.9 |

2006-3-13 |

1.97 |

1.422 |

3.75 |

7.25% |

5.172 |

7.61% |

4.9 |

2006-3-14 |

1.97 |

1.426 |

3.72 |

6.61% |

5.146 |

6.97% |

4.9 |

2006-3-15 |

1.96 |

1.4 |

3.7 |

5.41% |

5.1 |

5.76% |

4.9 |

2006-3-16 |

1.96 |

1.402 |

3.65 |

4.16% |

5.052 |

4.53% |

4.9 |

2006-3-17 |

1.96 |

1.386 |

3.6 |

2.39% |

4.986 |

2.76% |

4.9 |

2006-3-20 |

1.95 |

1.341 |

3.64 |

2.23% |

4.981 |

2.59% |

4.9 |

2006-3-21 |

1.95 |

1.373 |

3.63 |

2.84% |

5.003 |

3.20% |

4.9 |

2006-3-22 |

1.95 |

1.348 |

3.63 |

2.15% |

4.978 |

2.52% |

4.9 |

2006-3-23 |

1.94 |

1.303 |

3.69 |

2.52% |

4.993 |

2.88% |

4.9 |

2006-3-24 |

1.94 |

1.312 |

3.57 |

-0.50% |

4.882 |

-0.13% |

4.9 |

2006-3-27 |

1.93 |

1.334 |

3.55 |

-0.45% |

4.884 |

-0.08% |

4.9 |

2006-3-28 |

1.93 |

1.318 |

3.61 |

0.78% |

4.928 |

1.15% |

4.9 |

2006-3-29 |

1.93 |

1.294 |

3.64 |

0.93% |

4.934 |

1.30% |

4.9 |

2006-3-30 |

1.92 |

1.311 |

3.53 |

-1.67% |

4.841 |

-1.29% |

4.9 |

2006-3-31 |

1.92 |

1.275 |

3.58 |

-1.26% |

4.855 |

-0.88% |

4.9 |

2006-4-3 |

1.91 |

1.208 |

3.55 |

-4.00% |

4.758 |

-3.62% |

4.9 |

2006-4-4 |

1.91 |

1.198 |

3.62 |

-2.27% |

4.818 |

-1.89% |

4.9 |

2006-4-5 |

1.91 |

1.2 |

3.65 |

-1.37% |

4.85 |

-1.00% |

4.9 |

2006-4-6 |

1.90 |

1.23 |

3.58 |

-2.51% |

4.81 |

-2.14% |

4.9 |

2006-4-7 |

1.90 |

1.186 |

3.55 |

-4.62% |

4.736 |

-4.24% |

4.9 |

2006-4-10 |

1.89 |

1.157 |

3.61 |

-3.68% |

4.767 |

-3.31% |

4.9 |

2006-4-11 |

1.89 |

1.175 |

3.59 |

-3.76% |

4.765 |

-3.38% |

4.9 |

2006-4-12 |

1.89 |

1.208 |

3.56 |

-3.71% |

4.768 |

-3.33% |

4.9 |

2006-4-13 |

1.88 |

1.237 |

3.51 |

-4.36% |

4.747 |

-3.98% |

4.9 |

2006-4-14 |

1.88 |

1.187 |

3.61 |

-2.85% |

4.797 |

-2.48% |

4.9 |

2006-4-17 |

1.87 |

1.198 |

3.59 |

-3.12% |

4.788 |

-2.74% |

4.9 |

2006-4-18 |

1.87 |

1.198 |

3.58 |

-3.41% |

4.778 |

-3.03% |

4.9 |

2006-4-19 |

1.87 |

1.215 |

3.54 |

-4.10% |

4.755 |

-3.72% |

4.9 |

2006-4-20 |

1.87 |

1.22 |

3.56 |

-3.37% |

4.78 |

-2.99% |

4.9 |

2006-4-21 |

1.86 |

1.244 |

3.68 |

0.65% |

4.924 |

1.02% |

4.9 |

2006-4-24 |

1.85 |

1.355 |

3.55 |

0.14% |

4.905 |

0.52% |

4.9 |

2006-4-25 |

1.85 |

1.406 |

3.34 |

-4.61% |

4.746 |

-4.21% |

4.9 |

2006-4-26 |

1.85 |

1.406 |

3.34 |

-4.61% |

4.746 |

-4.21% |

4.9 |

2006-4-27 |

1.85 |

1.219 |

3.46 |

-6.39% |

4.679 |

-6.00% |

4.9 |

2006-4-28 |

1.84 |

1.206 |

3.42 |

-8.01% |

4.626 |

-7.62% |

4.9 |

2006-5-8 |

1.82 |

1.275 |

3.42 |

-5.99% |

4.695 |

-5.60% |

4.9 |

2006-5-9 |

1.81 |

1.335 |

3.53 |

-0.99% |

4.865 |

-0.61% |

4.9 |

2006-5-10 |

1.81 |

1.4 |

3.6 |

2.78% |

5 |

3.15% |

4.9 |

2006-5-11 |

1.81 |

1.35 |

3.66 |

3.01% |

5.01 |

3.37% |

4.9 |

2006-5-12 |

1.81 |

1.355 |

3.85 |

7.92% |

5.205 |

8.27% |

4.9 |

2006-5-15 |

1.80 |

1.43 |

3.9 |

11.03% |

5.33 |

11.36% |

4.9 |

2006-5-16 |

1.79 |

1.487 |

3.66 |

6.75% |

5.147 |

7.11% |

4.9 |

2006-5-17 |

1.79 |

1.404 |

3.88 |

9.90% |

5.284 |

10.24% |

4.9 |

2006-5-18 |

1.79 |

1.542 |

4.14 |

18.89% |

5.682 |

19.21% |

4.9 |

2006-5-19 |

1.79 |

1.501 |

4.11 |

17.30% |

5.611 |

17.62% |

4.9 |

2006-5-22 |

1.78 |

1.524 |

4.18 |

19.23% |

5.704 |

19.55% |

4.9 |

2006-5-23 |

1.78 |

1.634 |

3.92 |

16.68% |

5.554 |

17.02% |

4.9 |

2006-5-24 |

1.77 |

1.416 |

3.88 |

10.21% |

5.296 |

10.55% |

4.9 |

2006-5-25 |

1.77 |

1.421 |

3.86 |

9.87% |

5.281 |

10.21% |

4.9 |

2006-5-26 |

1.77 |

1.401 |

3.9 |

10.28% |

5.301 |

10.62% |

4.9 |

2006-5-29 |

1.76 |

1.495 |

3.99 |

14.66% |

5.485 |

14.99% |

4.9 |

2006-5-30 |

1.76 |

1.512 |

3.91 |

13.35% |

5.422 |

13.69% |

4.9 |

2006-5-31 |

1.75 |

1.488 |

3.87 |

11.83% |

5.358 |

12.17% |

4.9 |

2006-6-1 |

1.75 |

1.452 |

3.92 |

12.04% |

5.372 |

12.38% |

4.9 |

2006-6-2 |

1.75 |

1.292 |

3.86 |

6.53% |

5.152 |

6.87% |

4.9 |

2006-6-5 |

1.74 |

1.258 |

4 |

8.95% |

5.258 |

9.29% |

4.9 |

2006-6-6 |

1.74 |

1.303 |

4.07 |

11.62% |

5.373 |

11.95% |

4.9 |

2006-6-7 |

1.73 |

1.39 |

3.74 |

6.15% |

5.13 |

6.50% |

4.9 |

2006-6-8 |

1.73 |

1.37 |

3.78 |

6.61% |

5.15 |

6.97% |

4.9 |

2006-6-9 |

1.73 |

1.52 |

3.65 |

7.40% |

5.17 |

7.76% |

4.9 |

2006-6-12 |

1.72 |

1.497 |

3.66 |

7.02% |

5.157 |

7.38% |

4.9 |

2006-6-13 |

1.72 |

1.414 |

3.65 |

4.49% |

5.064 |

4.86% |

4.9 |

2006-6-14 |

1.72 |

1.441 |

3.58 |

3.38% |

5.021 |

3.75% |

4.9 |

2006-6-15 |

1.71 |

1.386 |

3.63 |

3.20% |

5.016 |

3.56% |

4.9 |

2006-6-16 |

1.71 |

1.29 |

3.69 |

2.17% |

4.98 |

2.53% |

4.9 |

2006-6-19 |

1.70 |

1.357 |

3.65 |

2.93% |

5.007 |

3.30% |

4.9 |

2006-6-20 |

1.70 |

1.35 |

3.72 |

4.57% |

5.07 |

4.93% |

4.9 |

2006-6-21 |

1.70 |

1.316 |

3.72 |

3.66% |

5.036 |

4.01% |

4.9 |

2006-6-22 |

1.69 |

1.274 |

3.75 |

3.31% |

5.024 |

3.66% |

4.9 |

2006-6-23 |

1.69 |

1.221 |

3.75 |

5.39% |

4.971 |

5.73% |

4.769 |

2006-6-26 |

1.68 |

1.213 |

3.85 |

7.64% |

5.063 |

7.98% |

4.769 |

2006-6-27 |

1.68 |

1.184 |

3.93 |

8.78% |

5.114 |

9.11% |

4.769 |

2006-6-28 |

1.68 |

1.229 |

3.89 |

9.00% |

5.119 |

9.33% |

4.769 |

2006-6-29 |

1.67 |

1.244 |

3.93 |

10.31% |

5.174 |

10.64% |

4.769 |

2006-6-30 |

1.67 |

1.21 |

3.84 |

7.32% |

5.05 |

7.66% |

4.769 |

2006-7-3 |

1.66 |

1.203 |

3.85 |

7.38% |

5.053 |

7.72% |

4.769 |

2006-7-4 |

1.66 |

1.229 |

3.82 |

7.33% |

5.049 |

7.67% |

4.769 |

2006-7-5 |

1.66 |

1.218 |

3.75 |

5.31% |

4.968 |

5.65% |

4.769 |

2006-7-6 |

1.65 |

1.191 |

3.89 |

8.02% |

5.081 |

8.36% |

4.769 |

2006-7-7 |

1.65 |

1.108 |

3.94 |

7.08% |

5.048 |

7.42% |

4.769 |

2006-7-10 |

1.64 |

1.038 |

3.97 |

6.02% |

5.008 |

6.35% |

4.769 |

2006-7-11 |

1.64 |

0.957 |

4.13 |

7.70% |

5.087 |

8.02% |

4.769 |

2006-7-12 |

1.64 |

1.005 |

4.03 |

6.60% |

5.035 |

6.93% |

4.769 |

2006-7-13 |

1.64 |

1.177 |

3.78 |

4.97% |

4.957 |

5.32% |

4.769 |

2006-7-14 |

1.63 |

1.186 |

3.79 |

5.46% |

4.976 |

5.81% |

4.769 |

2006-7-17 |

1.62 |

1.235 |

3.8 |

7.00% |

5.035 |

7.34% |

4.769 |

2006-7-18 |

1.62 |

1.24 |

3.79 |

6.89% |

5.03 |

7.23% |

4.769 |

2006-7-19 |

1.62 |

1.35 |

3.67 |

6.84% |

5.02 |

7.19% |

4.769 |

2006-7-20 |

1.62 |

1.2 |

3.72 |

4.06% |

4.92 |

4.41% |

4.769 |

2006-7-21 |

1.61 |

1.228 |

3.73 |

5.07% |

4.958 |

5.42% |

4.769 |

2006-7-24 |

1.61 |

1.265 |

3.66 |

4.26% |

4.925 |

4.62% |

4.769 |

2006-7-25 |

1.60 |

1.205 |

3.71 |

3.94% |

4.915 |

4.29% |

4.769 |

2006-7-26 |

1.60 |

1.236 |

3.7 |

4.51% |

4.936 |

4.87% |

4.769 |

2006-7-27 |

1.60 |

1.262 |

3.65 |

3.92% |

4.912 |

4.27% |

4.769 |

2006-7-28 |

1.59 |

1.214 |

3.64 |

2.34% |

4.854 |

2.69% |

4.769 |

2006-7-31 |

1.59 |

1.265 |

3.59 |

2.40% |

4.855 |

2.76% |

4.769 |

2006-8-1 |

1.58 |

1.259 |

3.56 |

1.40% |

4.819 |

1.77% |

4.769 |

2006-8-2 |

1.58 |

1.289 |

3.47 |

-0.29% |

4.759 |

0.09% |

4.769 |

2006-8-3 |

1.58 |

1.27 |

3.48 |

-0.55% |

4.75 |

-0.17% |

4.769 |

2006-8-4 |

1.58 |

1.27 |

3.46 |

-1.13% |

4.73 |

-0.75% |

4.769 |

2006-8-7 |

1.57 |

1.24 |

3.48 |

-1.41% |

4.72 |

-1.03% |

4.769 |

2006-8-8 |

1.56 |

1.179 |

3.54 |

-1.41% |

4.719 |

-1.04% |

4.769 |

2006-8-9 |

1.56 |

1.208 |

3.5 |

-1.74% |

4.708 |

-1.37% |

4.769 |

2006-8-10 |

1.56 |

1.201 |

3.52 |

-1.36% |

4.721 |

-0.99% |

4.769 |

2006-8-11 |

1.56 |

1.202 |

3.51 |

-1.62% |

4.712 |

-1.25% |

4.769 |

2006-8-14 |

1.55 |

1.239 |

3.5 |

-0.86% |

4.739 |

-0.48% |

4.769 |

注: 認沽權證溢價率=(標的股票價格+認沽權證價格-行權價)/標的股票價格

(作者系銀河證券研究中心高級研究員)

新浪財經提醒:>>文中提及相關個股詳細資料請在此查詢